End of Month

Last week Wednesday we had one of the biggest swings in the markets 39.75 points exceeding even the the 4/15 Boston Bombing day. The fed language was highly scrutinized as to whether there would be a slowing of QE. The markets hung on every word that spewed out of Ben’s mouth as he testified before Congress. Volatility days create lots of opportunity as long as your trading the right side of the market. Last Wednesday was the first day in a while where the dip buyers continued to get run over all day. To top off the selling pressure we had a gap down day the following morning to insult injury even more for the buyers who were really stuck.

So one might ask what is the best way to trade those days? The easiest answer is to walk away. turn the screens off and know that the markets will be there tomorrow. Having worked with coaching clients throughout the years I have seen many train wrecks where people will blow out accounts just to prove a point in thinking that they can beat the market or push it in their favor. The market is a beast, it can be your worse enemy when trying to tame it.

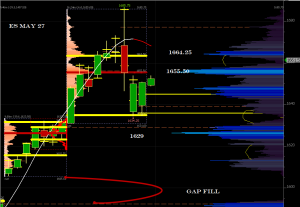

When you look at the recent structure in the market you will notice that there has not been much backfilling. The key areas of volume in this last move up are the 1655.50 area followed by 64 and 26 below. You will notice that the profile has air pockets of price action where there was not much trading. Last weeks move lower has created the first signs of some structured development since the gap up on May 3. How we trade and where we trade over the next few weeks will tell us alot about if this valuation area can hold and be sustained to take us higher.

As we say goodbye to May and the summer trade begins, we have plenty of areas to test before the beast continues to move to new highs. Trade the edge and wait for the market to come to your execution spot so that you can slay the beast instead of it being the other way around.